Ready to Reboot Your Reality?

Register For the Rogue Consciousness Reboot!

Coming Soon

Under Construction! Bookmark this page, and come back soon to check out the presentation.

In the mean time be sure to follow us on all our socials and check out some of our latest blogs so you don't miss a thing!

Is Your TV Broken?

Celebrating 14 Years: The Secret to a Thriving Relationship

Is your TV broken?

That's the question someone tossed my way today, half-joking, when I mentioned how my partner and I spent our evening after a lovely anniversary dinner out. It's the sad reality of today in motion. The kind of relationship like we have is not normal.

No binge-watching the latest series, no scrolling through endless streaming options. Instead, we climbed into bed and just... talked. For hours. Sharing stories, dreams, laughs, and those quiet moments that make life feel full.

A broken television set. Source: https://stock.adobe.com/search?k=broken+television

They couldn't wrap their head around it—how could any couple possibly choose conversation over the glow of a screen or some other distraction? Anything, but actually talking to and liking your spouse to go along with your love.

But that's exactly what our relationship is built on. After 14 years of marriage (and nearly 20 years together total), we've learned that true connection comes from giving all of ourselves to each other without expectation of return.

It's not about grand gestures every day; it's about those simple, intentional moments. It's about choosing to flex your "unconditional love" muscle.

We share our space in peace, even when we're not doing the same thing. One of us might be reading while the other journals, or we might put on a podcast, movie, or show in the same room while the other plays a game. The point is, we just enjoy each other's company. No distractions needed, although we do engage in our favorite activities, together and apart. It's not the same as sitting in the recliner, refusing to talk to each other, because of some little tiff or misunderstanding.

And yes, that evening culminated in passion that felt as fresh and intense as our early days—banging like there's no tomorrow. It's a far cry from our first few years, which were rocky and disconnected, filled with misunderstandings, poor health, and emotional distance. We've grown, healed, and built something real.

In a world that's always pushing us toward more noise, more screens, more busyness, or someone new we've chosen the renegade path: presence over perfection. It's what keeps our bond strong and our love alive.

If this resonates with you—if you're ready to nurture deeper connections in your own life while embracing a full-spectrum approach to wellness—check out the Full Spectrum Renegade Cookbook. It's packed with recipes that fuel your body and mind for those meaningful moments.

P.S. After you pick up a copy for yourself and some friends, be on the lookout for the special founders deal on The Renegade Resource Collective Membership for exclusive tips, community support, and resources to live boldly and connected.

What are you waiting for? Turn off the TV and start building the life you deserve today!

"Navigate Your Freelance Income with Confidence—Expert Financial Planning Awaits!"

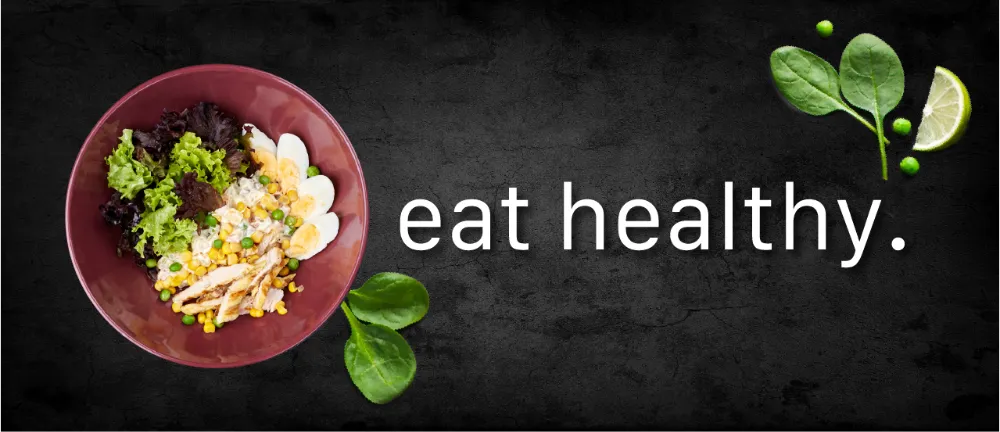

Register for our Daily Recipe newsletter.

Get daily healthy recipes delivered to your inbox and join our community of food enthusiasts enjoying our creations.

Secure Your Financial Future Today

Master Your Future: Expert Financial Planning Webinar

Learn strategies to grow and protect your wealth with expert guidance in our upcoming financial planning webinar.

Financial Solutions for Every Life Stage

We offer wealth accumulation, retirement planning, investment management, tax strategies, and estate planning to meet your financial goals.

Wealth Accumulation Strategies

Boost your wealth with tailored investments, savings strategies, and smart budgeting.

Retirement Planning Solutions

Secure your retirement with personalized plans tailored for a fulfilling life after work.

Tax Optimization & Estate Planning

Preserve your wealth with expert tax planning and estate management for future generations

Speaker

The Best

— Sarah M

Business Owner

Managing finances with unpredictable income can be tricky, but it’s not impossible! Join me in this webinar where I’ll talk about the tools and techniques I’ve adopted to handle irregular income, save consistently, and stay prepared for tax season. Financial planning is key to stability, and I can’t wait to show you how I’ve made it work.

— David L

Retired Engineer

If you’ve ever felt overwhelmed by freelance finances, this webinar is for you! I’ll be discussing how separating personal and business finances has transformed the way I manage my money. I’ll also share insights on retirement planning, because even freelancers need to plan for the future!

Thanks to their financial planning services, I now feel secure about my future and my family’s financial well-being!

Retired Engineer

Got Question?

We've got answers

In your freelancing journey, you likely have many questions and concerns. Our goal is to help you navigate through them, which is why we've compiled answers to the most common questions. Whether you need insights on budgeting, taxes, or financial planning, our comprehensive FAQ section is here for you. If you don’t find your question listed, feel free to ask us—we’re here to assist you!

What are the best budgeting practices for freelancers?

Freelancers should track all income and expenses meticulously. Consider using budgeting apps or spreadsheets to categorize expenses and set financial goals. Aim to save a portion of your income each month to cover lean periods.

How do I handle taxes as a freelancer?

As a freelancer, you are responsible for reporting your income and paying taxes. It's essential to keep detailed records of your earnings and expenses. You may want to consult a tax professional to understand your obligations and maximize deductions.

What should I include in my financial plan?

A comprehensive financial plan for freelancers should include budgeting, savings goals, retirement planning, and an emergency fund. Additionally, consider setting aside money for taxes and investing in professional development.

How can I manage irregular income?

Managing irregular income involves creating a buffer. Set aside a portion of your earnings during high-earning months to cover expenses during leaner times. Building an emergency fund can also provide stability and peace of mind.

What are the advantages of having a separate business account?

Having a separate business account helps streamline your finances by keeping personal and business expenses distinct. This makes it easier to track income, manage cash flow, and prepare for taxes, reducing the risk of financial confusion.

Unlock Your Path to a Dream Home

Discover the Secrets of Successful DIY Renovations

...ARE YOU READY TO TRANSFORM YOUR SPACE?!

X

X